- Transforming the Insurance Industry Through AI Chatbot :

- Insurance Chatbots :

- The Challenges Insurance Industry is Facing :

- Chatbot : Navigating the Insurance Industry Challenges with AI Assistance.

- Chatbots Diverse Use Cases in Insurance :

- Botbuz : Chatbot Shaping the Future of The Insurance Industry.

Transforming the Insurance Industry through AI Chatbot :

The insurance industry, traditionally known for its paper-heavy processes and human-centric interactions. It is undergoing a significant transformation thanks to AI-powered chatbots. These intelligent virtual assistants are reshaping the way insurance companies interact with customers. It is offering numerous benefits and driving a wave of innovation across the sector.

- AI-powered chatbots are transforming the insurance industry by :

- Improving customer experience with faster, more personalized service.

- Streamlining processes and increasing operational efficiency.

- Reducing costs and preventing fraud.

- Providing valuable data for better decision-making.

Insurance Chatbots :

An insurance chatbot is a virtual assistant powered by Artificial Intelligence (AI). It interacts with customers on behalf of insurance companies. These chatbots act as a bridge between customers and insurance providers. Thus, offering information, support, and personalized assistance throughout the insurance journey.

Insurance chatbots are revolutionizing how customers interact with insurance companies. They provide a convenient, personalized, and efficient experience. It also aids in improving company operations and risk management. As AI technology continues to evolve, we can expect even more advanced capabilities. Also a deeper integration of chatbots into the insurance landscape.

The Challenges Insurance Industry is Facing :

The insurance industry aims to provide security and peace of mind. But it often faces challenges that can leave customers frustrated and dissatisfied. Here are some key issues plaguing the industry :

- Complex Processes : It helps in navigating intricate policy documents & files claims. Insurance processes can be confusing and time-consuming at times. Customers often struggle to understand the intricacies of their coverage. They face difficulties completing tasks, leading to frustration and dissatisfaction.

- Long Wait Times : Reaching a human representative on the phone can be an ordeal. It has long wait times & frustrating automated menus. This lack of immediate assistance. It can be stressful during times of need, like filing a claim after an unexpected event.

- Lack of Personalized Support : Insurance often feels impersonal, with generic communication and a one-size-fits-all approach. Customers desire personalized support that understands their specific needs & concerns. It fosters a feeling of value & trust.

- Limited Accessibility : Traditional interactions are restricted to business hours & specific channels. It makes it difficult for customers to access information or support outside those parameters. This lack of flexibility can be inconvenient & frustrating for busy individuals.

These challenges collectively create a complex maze for both customers & insurance companies. However, innovative solutions like AI-powered chatbots and data-driven analytics are emerging. It helps to address these issues. Thus, paving the way for a more customer-centric & efficient insurance experience.

Impact on Customer Satisfaction and Operational Efficiency :

These challenges have a significant negative impact on both customer satisfaction & operational efficiency :

Customer Satisfaction : Frustration with complex processes, long wait times, and impersonal interactions. It can lead to low customer satisfaction and brand loyalty. Customers may choose competitors who offer a more streamlined and personalized experience.

Operational Efficiency : Inefficient processes and data silos can lead to higher operational costs. It also slower turnaround times & increased errors. This can negatively impact profitability and competitiveness.

Chatbots : Navigating the Insurance Industry Challenges with AI Assistance

The insurance industry faces several challenges, impacting both customer satisfaction and operational efficiency. Luckily, AI-powered chatbots offer a promising solution. It holds the potential to revolutionize the industry. Here’s how chatbots can address these challenges :

Streamlining Complex Processes :

Simplify Policy Management : Chatbots can guide customers through intricate processes. It can guide in policy selection, adjustments & renewals. Thus, breaking down complex steps into clear and user-friendly interactions.

Intuitive Claims Filing : Chatbots can guide customers through the claims process, gathering information & filing claims electronically. Thus, providing updates on the status, all in a user-friendly format.

Reduce Errors with AI Assistance : Chatbots can verify information, identify inconsistencies, and suggest corrections. Thus, minimizing errors and streamlining the overall process.

Improving Customer Service :

24/7 Availability : Chatbots provide instant support 24/7. It eliminates wait times and offers assistance whenever needed, especially during peak hours.

Personalized Interactions : By leveraging customer data and preferences, chatbots can offer personalized recommendations. It can also answer relevant questions, and provide tailored guidance, fostering better engagement.

Faster Response Times : Chatbots can handle routine inquiries and basic tasks quickly. Thus, freeing up human agents to focus on more complex issues & personalized interactions. It also leads to faster resolution times.

Enhancing Operational Efficiency :

Automated Tasks : Chatbots can automate repetitive tasks like answering FAQs, collecting claim information & processing payments. Thus, freeing up human resources for higher-value activities.

Reduced Operational Costs : By automating tasks and reducing wait times, chatbots can significantly lower operational costs. The costs which are associated with call centers and manual processes.

Data-driven Insights :

Chatbots can collect valuable data from customer interactions. It provides insights into customer behavior and preferences. This data can be used to improve processes, personalize offerings & predict future needs.

By embracing chatbots & integrating them, insurance companies can navigate the challenges they face. They can emerge as leaders in a customer-centric, efficient & competitive future. The journey is ongoing, with advancements in AI & machine learning. It promises even more transformative solutions for the insurance landscape.

Chatbots Diverse Use Cases in Insurance :

The versatility of AI chatbots allows it to integrate into various aspects of the insurance industry. It offers innovative solutions for both customer-facing & internal processes. Here’s an overview of how companies can leverage chatbots for different tasks :

Customer Service :

24/7 Support : Answer basic questions, provide policy information & resolve routine issues anytime, anywhere.

Personalized Interactions : Offer greetings by name, recommend relevant products, and address individual concerns.

Multilingual Support : Cater to a diverse customer base by offering language options. Thus, breaking down communication barriers.

Proactive Engagement : Send reminders, offer policy updates & suggest personalized recommendations to improve engagement.

Claims Processing :

Claim Initiation : Guide customers through the claim filing process. It collects necessary information & initiates claims efficiently.

Status Updates : Provide real-time updates on claim progress. Also answer questions about the process & offer support.

Document Collection : Securely collect photos, videos, and other documentation directly through the chatbot interface.

Fraud Detection : Analyze data and conversational patterns to identify potential fraudulent activity.

Policy Inquiries :

Policy Information : Provide details about coverage, deductibles, and exclusions in a clear and concise manner.

Payment Processing : Facilitate secure online payments for premiums and renewals.

Policy Changes : Assist customers with updating policies, adding coverage, or making endorsements.

Renewal Reminders : Send automated reminders and offer renewal options through the chatbot interface.

Lead Generation :

Pre-qualify leads : Engage potential customers with interactive quizzes and questions. It helps to assess their needs and eligibility.

Collect information : Gather contact details and preferences to build targeted marketing campaigns.

Product recommendations : Suggest suitable insurance products based on individual needs and risk profiles.

Schedule appointments : Connect qualified leads with sales representatives for further interaction.

Internal Processes :

Employee Onboarding : Guide new employees through company policies, benefits, and procedures.

Training and Development : Deliver bite-sized training modules and answer employee questions on various topics.

Data Collection and Reporting : Automate data collection from internal processes and generate reports for analysis.

Risk Management : Analyze internal data to identify potential risks and suggest preventive measures.

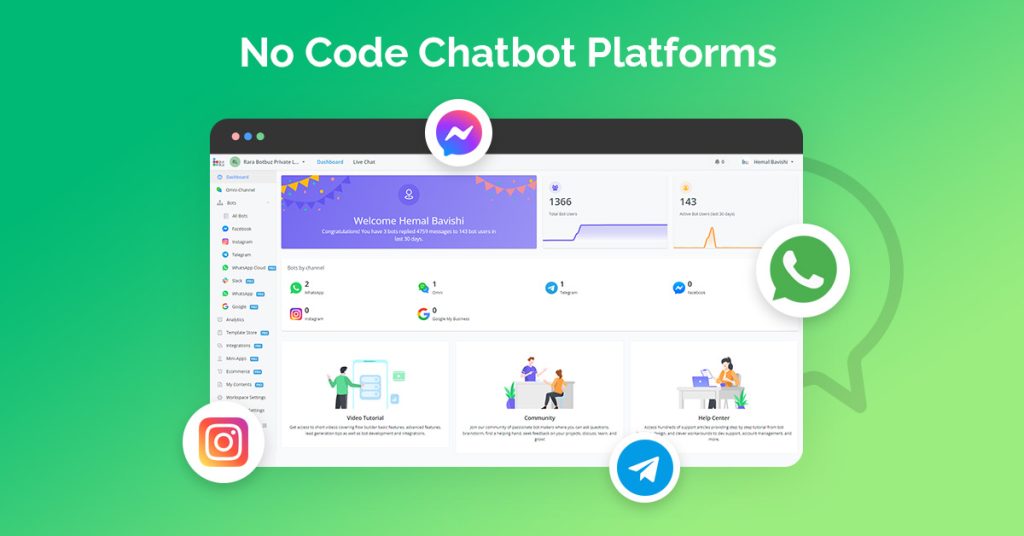

Botbuz : Chatbots Shaping the Future of the Insurance Industry

Chatbots are transforming the insurance landscape. It offers numerous benefits for both customers and providers. While the technology is widely available, Botbuz stands out with its specific focus on the insurance industry & its commitment to delivering innovative solutions. Let’s delve into what makes Botbuz’s insurance chatbot unique :

Key Advantages of Botbuz Chatbot :

Botbuz offers a suite of AI-powered chatbots specifically designed for the insurance industry. These chatbots go beyond generic solutions. It provides innovative features & functionalities. Thus, tailoring to the unique needs of insurance companies & their customers.

Enhanced Customer Experience : Botbuz chatbots offer 24/7 support. It provides personalized interactions, and multilingual capabilities, significantly improving customer satisfaction and engagement.

Streamlined Processes : From filing claims & updating policies to making payments & answering FAQs, Botbuz chatbots automate tasks. It also simplifies processes by improving efficiency and reducing customer effort.

Data-driven Insights : Botbuz chatbots collect and analyze customer interactions. It helps in generating valuable data that helps insurance companies understand customer needs. It also personalizes offerings & improves risk management.

Cost Savings : Chatbots automates tasks & reduces call center volume. Thus, significantly reduce operational costs for insurance companies.

Scalability and Integration : Botbuz chatbot seamlessly integrate with existing insurance systems and workflows. Thus, ensuring a smooth implementation and scalable solution.

Examples of Innovation :

Claims Processing : Botbuz chatbots guide customers through the claim filing process. It collects information efficiently, and even facilitates document upload. Thus, leading to faster claim processing and reduced turnaround times.

Policy Management : Customers can easily access and manage their policies through the chatbot. It also updates information, making payments & even requesting changes, within a user-friendly interface.

Risk Assessment and Underwriting : Botbuz can use AI & data analytics to personalize risk assessments. It also offers competitive quotes based on individual customer profiles.

Looking to the Future :

Botbuz is continuously innovating and evolving its chatbot solutions. By integrating cutting-edge technologies like natural language processing & machine learning, Botbuz aims to create even more personalized and intelligent interactions. Thus, revolutionizing the insurance industry.

Do you have specific questions about Botbuz’s insurance chatbot solutions? Perhaps you’re curious about their pricing, specific features for a particular type of insurance, or success stories from current clients. Feel free to ask & I’ll do my best to provide you with relevant information based on my knowledge and the publicly available information about Botbuz.