- The role of chatbots in modern banking :

- The rise of WhatsApp as a communication channel in banking sector :

- Defining Whatsapp chatbots and their capabilities :

- Enahancing customer service :

- Transaction assistance :

- Security and compliance :

- The future of WhatsApp chatbot in banking :

- Using Botbuz WhatsApp chatbot in banking sector :

- Conclusion :

The role of chatbots in modern banking :

The banking sector is rapidly changing, with new technologies emerging all the time. Customers are demanding more convenient and personalized services. So banks are looking for ways to reduce costs and improve efficiency.

Chatbots can play a major role in helping banks meet these challenges. They can provide 24/7 customer support, answer questions about products and services. They can even help customers complete transactions. Chatbots can also be used to collect data about customer behavior and preferences, which can be used to improve products and services.

The rise of WhatsApp as a communication channel in the banking sector:

WhatsApp is one of the most popular messaging apps in the world, with over 2 billion active users. It is also becoming increasingly popular as a communication channel in the banking sector.

There are several reasons for this. First, WhatsApp is free and easy to use. Second, it is a secure platform, with end-to-end encryption. Third, WhatsApp is available on a variety of devices, making it convenient for customers to use.

Banks are using WhatsApp to provide customer support, answer questions, and even complete transactions. For example, customers can use WhatsApp to check their account balance, transfer money & pay bills.

Defining WhatsApp chatbots and their capabilities :

WhatsApp chatbots are automated software programs. It can simulate conversation with humans on the WhatsApp messaging platform. They can provide customer support, answer questions, & even complete transactions.

WhatsApp chatbots are powered by artificial intelligence (AI). It allows them to understand and respond to human language in a natural way. They can also be integrated with other systems, such as bank account databases & payment processors. Thus, providing a more comprehensive range of services.

WhatsApp chatbots can perform a variety of tasks, including :

- Answering customer questions about products and services.

- Resolving customer issues.

- Providing general customer support.

- Checking account balances.

- Viewing transaction history.

- Transferring money.

- Paying bills.

- Sending money to friends and family.

- Making online purchases.

- Creating budgets.

- Tracking spending.

- Setting financial goals.

Enhancing Customer Service :

- 24/7 availability : WhatsApp chatbots are available 24 hours a day, 7 days a week. This means that customers can get help with their banking needs whenever they need it, regardless of the time of day or where they are in the world.

- Instant responses : WhatsApp chatbots can provide instant responses to customer queries. This is because they are not constrained by the same factors as human customer service representatives, such as the need to take breaks or deal with other customers.

- Resolving common queries : WhatsApp chatbots can be used to resolve common customer queries, such as checking account balances, transferring money, and paying bills. This frees up human customer service representatives to focus on more complex issues.

Transaction Assistance :

WhatsApp chatbots can be used to facilitate a variety of transactions, including fund transfers, balance inquiries and bill payments.

Fund transfers : A customer can use a WhatsApp chatbot to transfer money from one account to another, either within the same bank or to another bank. The chatbot can guide the customer through the process and provide them with any necessary information, such as the recipient’s bank account number and routing number.

Balance inquiries : A customer can use a WhatsApp chatbot to check the balance of their bank account or credit card account. The chatbot will provide the customer with their current balance and any other relevant information, such as upcoming due dates and interest charges.

Bill payments : A customer can use a WhatsApp chatbot to pay their bills online. The chatbot can provide the customer with a list of their upcoming bills, and the customer can choose which bills they want to pay. The chatbot will then process the payment and provide the customer with a confirmation.

In addition to these specific examples, WhatsApp chatbots can also be used to facilitate other types of transactions, such as opening new bank accounts, applying for loans, and redeeming rewards points.

Security and Compliance :

Ensuring data security and privacy with WhatsApp chatbots

Banks need to take a number of steps to ensure data security and privacy when using WhatsApp chatbots. These steps include:

- Using end-to-end encryption : WhatsApp uses end-to-end encryption by default, which means that only the sender and receiver of a message can read it. This is an important security feature, especially when handling sensitive customer data.

- Implementing strong authentication : Banks should implement strong authentication measures to ensure that only authorized users can access their WhatsApp chatbots. This could involve using multi-factor authentication, such as a one-time password (OTP) sent to the user’s phone.

- Educating customers about security : Banks should educate their customers about security best practices when using WhatsApp chatbots. This includes advising customers to avoid clicking on links in messages from unknown senders and to be wary of phishing attempts.

Compliance with banking regulations and industry standards

Banks also need to ensure that their WhatsApp chatbots comply with all applicable banking regulations and industry standards. This could include regulations related to anti-money laundering, know-your-customer requirements, and data protection.

Here are some specific examples of how banks can ensure compliance with banking regulations and industry standards when using WhatsApp chatbots :

- Implementing KYC procedures : Banks should implement KYC procedures to verify the identity of their customers before they are allowed to use WhatsApp chatbots to complete transactions.

- Monitoring transactions : Banks should monitor transactions processed through WhatsApp chatbots to detect and prevent fraudulent activity.

- Auditing logs : Banks should regularly audit the logs of their WhatsApp chatbots to ensure that they are compliant with all applicable regulations.

Personalization and User Experience :

Chatbots on WhatsApp can provide a personalized experience by tailoring interactions to individual customer needs and preferences.

This can be done in a number of ways, including :

Using customer data : Chatbots can use customer data, such as transaction history, purchase history, and product usage data, to tailor their interactions with customers. For example, a chatbot can recommend products and services to a customer based on their past purchases or browsing behavior.

Understanding customer preferences : Chatbots can use natural language processing (NLP) to understand customer preferences. For example, a chatbot can ask a customer what kind of products they are interested in and then use that information to provide more relevant recommendations.

Adjusting the conversation based on customer feedback : Chatbots can adjust the conversation based on customer feedback. For example, if a customer says that they are not interested in a particular product, the chatbot can avoid recommending that product in the future.

The Future of WhatsApp Chatbots in Banking :

- Chatbots will become more personalized. Chatbots will be able to use AI to learn more about each customer’s individual needs and preferences. This will allow them to provide more personalized recommendations and assistance.

- Chatbots will be able to handle more complex tasks. Chatbots will become more capable of handling complex tasks, such as opening new bank accounts, applying for loans and investing in financial products.

- Chatbots will be integrated with other banking systems. Chatbots will be more tightly integrated with other banking systems, such as bank account databases and payment processors. This will allow them to provide customers with a more seamless and efficient experience.

- Chatbots will be available in more languages. Chatbots will be available in more languages, making them accessible to a wider range of customers.

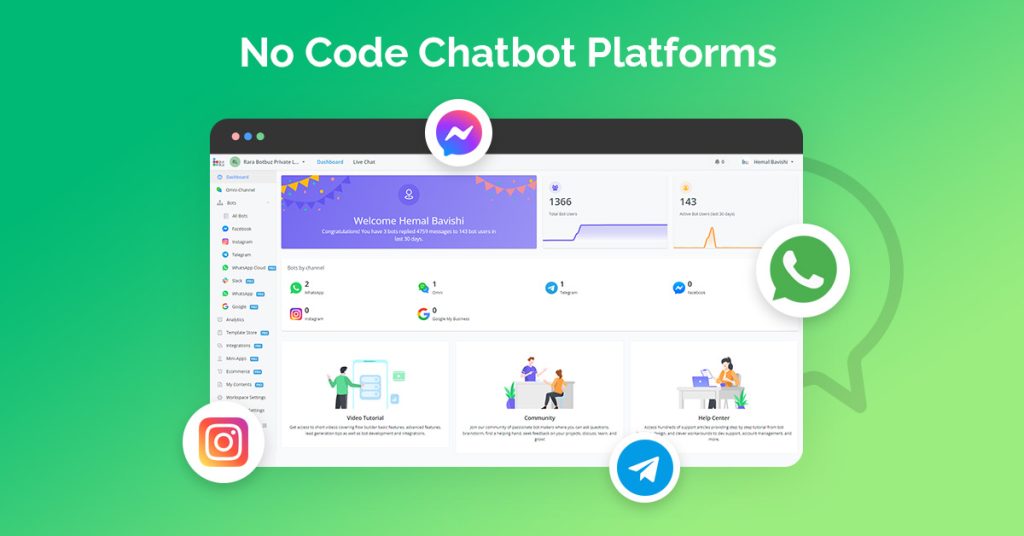

Using Botbuz WhatsApp chatbot in banking sector :

Botbuz WhatsApp chat bot can be used in the banking sector to improve customer service, reduce costs, and increase customer satisfaction. Here are some specific examples:

- Customer service : Botbuz WhatsApp chat bot can be used to answer customer questions, resolve customer issues, and provide general support. For example, the chatbot can answer questions about account balances, transaction history, and product information. It can also help customers to reset their passwords, file disputes, and more.

- Account management : Botbuz WhatsApp chat bot can be used to help customers with account management tasks, such as checking account balances, viewing transaction history, and transferring money. This can free up human customer service representatives to focus on more complex tasks.

- Payments : Botbuz WhatsApp chat bot can be used to help customers make payments, such as bill payments, loan payments, and credit card payments. This can make it easier and more convenient for customers to pay their bills.

- Financial planning : Botbuz WhatsApp chat bot can be used to help customers with financial planning tasks, such as budgeting, saving, and investing. For example, the chatbot can help customers to create a budget, track their spending, and find investment products that are right for them.

Conclusion :

WhatsApp chatbots have the potential to transform the banking sector by improving customer service & operational efficiency.

It can provide customers with 24/7 access to banking services, answer their questions quickly and accurately. It also helps to resolve their issues efficiently. Chatbots automate many tasks that are currently performed by human customer service representatives, which can save banks money.

In addition, WhatsApp chatbots can collect data about customer behavior and preferences. This data can improve products & services & to target marketing campaigns more effectively.

Overall, WhatsApp chatbots have the potential to make banking more convenient, efficient & personalized for customers.